A Complete Introduction to NFTs, Blockchain and Crypto

Crypto, blockchain and NFTs are all the rage at the moment. After reading this easy-to-understand primer you will understand why.

While the headline of this article could qualify for a prize in the Buzzword Olympics, there is a reason why all three terms - NFT, Blockchain and cryptocurrency - are being strung together. There is undoubtedly a chance that you are here because you were looking for a primer on only one or two of these terms, but I hope that by reading this article you will come to realise how a more fundamental understanding of how they all relate is extremely helpful in navigating the volatile minefield of whichever buzzword has caught your interest in the lead-up to this point. And hey, it might ignite your curiosity in one of the other subjects too.

Introduction

Before I begin, let me start by framing what this article is and isn’t aiming to achieve, and who it is and isn’t for.

Firstly, and most importantly, this is not a “how to” article. I will not be taking you through the steps of how to mint your own NFT or invest in Bitcoin. Secondly, this is not a history lesson. While the story of crypto is actually rather fascinating - for people like me, anyway - it is beyond the scope of this article.

This is, rather, a reasonably detailed primer on crypto, blockchain and NFTs for people who have heard of these things but don’t know much about what they really mean or how they work. Blockchain technology (which is, as you will learn, the underlying technology for cryptocurrencies and NFTs, and therefore the real foundation of this article) is fairly complex and technical, but its core concepts are actually quite straightforward.

My goal in this article is to elaborate on those concepts and, wherever possible, relate them to more familiar concepts that will help demystify it all. To do this I will, at times, be going really back to basics on some topics that you are already familiar with, so I would simply ask you to bear with me through those as there is rhyme to my reason. I will also, where possible, lift the hood on some of these concepts so you can see what they actually look like, not with a goal of explaining code to you but more to show that these are not abstract weird voodoo props but rather mundane and unscary things.

So grab a cup of tea (or coffee, I’m English but I don’t judge) and settle in for some good old-fashioned learning. I promise I’ll make it interesting.

TL:DR; - I’m busy, give me the short version

In the next section I will take you through each technology in some detail and, for each technology, explain what it is and how it works. The order I will explain them in matters as you will see, but before getting into it here are quick definitions of each technology to get you started, which you could also treat as a TL;DR.

- Blockchain: the easiest way to think about blockchains is as digital ledger systems where instead of an accountant or similar entity checking the debits and credits, the checks are performed by thousands of computers across the world, anonymously. Each computer - called a “node” in blockchain parlance - carries a complete copy of the entire history of transactions on the blockchain, and every time a new transaction is made that record is updated on every single node computer. This is what makes blockchains almost impossible to hack: a hacker would need to break into every node computer simultaneously and change the transaction, which is an entirely different proposition than hacking into a single server. The word “block” refers to a single batch of transactions, and “chain” is the entire history of blocks, hence the word “blockchain” essentially means “full history of transactions”.

- Cryptocurrency: the actual process of verifying a block on a blockchain sounds a little esoteric at first, but basically it’s a bunch of computer nodes racing against each other to crack a deliberately complex encrypted code (called a hash) generated by a blockchain transaction. This type of decryption takes considerable amounts of computing power (or the resurrection of Alan Turing), which in turn costs electricity and time - about 10 minutes for each Bitcoin block, for example. This system was implemented to make it deliberately slow and hard to modify the blockchain, which puts off fraudsters and hackers. But, in order to incentivise people to commit such time and computing power, the concept of cryptocurrency was born as a way of rewarding people for that work. The first person to successfully solve the computations required to decrypt a blockchain block will be rewarded with a pre-determined amount of cryptocurrency such as Bitcoin, which is why this process is often referred to as mining. A Bitcoin or other cryptocurrency, once created (or minted), is represented as a “token” that can then be exchanged on the blockchain where it was minted.

- NFT: the newest buzzword to hit the mainstream out of the blockchain world, NFT stands for Non Fungible Token and has nothing to do with fungi. Rather, it is an outcome of one of the more exciting capabilities of certain blockchains, smart contracts (which I will explain in more detail below). In its simplest terms, an NFT is just another token like cryptocurrency coins, except that it cannot be exchanged like crypto coins can (this is what non-fungible means), and has additional functionality in it (literally miniature programmes) that execute specific conditions, like a contract. The easiest way to think of NFTs is as contracts or certificates that prove ownership of something. They are minted in much the same way as crypto coins, but contain more data than a crypto coin. That data can be anything a computer can store, such as a digital image, music file or even a PDF. Every time the ownership of the NFT is transferred (via a sale, much like a real life certificate of ownership for, say, a painting), that transfer is recorded on the blockchain like any other transaction.

If that short and sweet breakdown is sufficient for you then congratulations, you are now a blockchain expert and my work here is done. But if you are still scratching your head somewhat, or are curious to learn more about the workings of these mysterious technologies then the following sections will dive a little deeper into each of them.

A deep-ish dive into blockchain etc

Part 1: blockchain

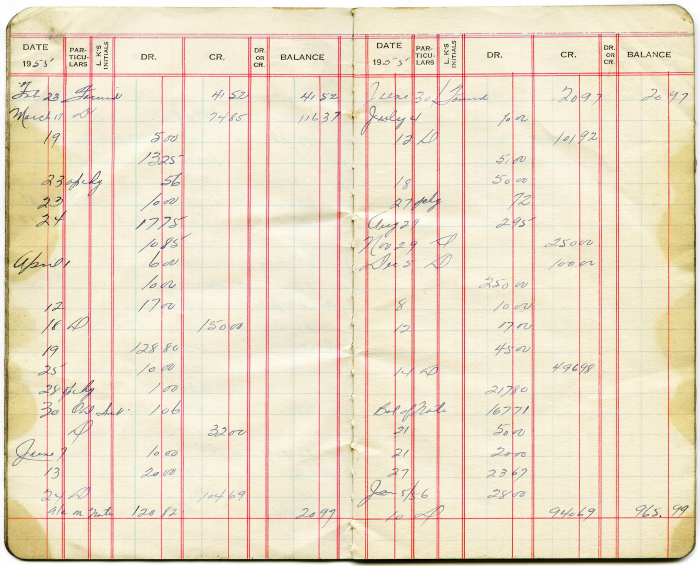

As mentioned in my short explanation above, a blockchain is something akin to a ledger of transactions, very similar in concept to the record-keeping ledgers accountants have been using for hundreds of years to record sales and purchases, with debits (sales) on one side and credits (purchases) on the other side of the page. Here’s what a ledger used to look like, in case you’re not old enough to remember life before Excel:

So why do blockchains exist, if we have ledgers and Excel? In one word: trust.

Think about how transactions are made in the physical world. In ye olden days it was all quite simple: person A would trade an item with person B on the basis that both parties agreed that the items being exchanged were of equal value. Later came cash, where value was pre-assigned to the coins you held and could be exchanged for items of equal value that way instead. In both scenarios you’re exchanging items of equal value: the major difference is in who decides on the value of those items. In the case of cash, a government central bank creates the coins (a process called minting) and, in simplistic terms, controls the value of it. Everyone else then decides how many coins the things they are selling are worth to them, which is the basic foundation of an economy.

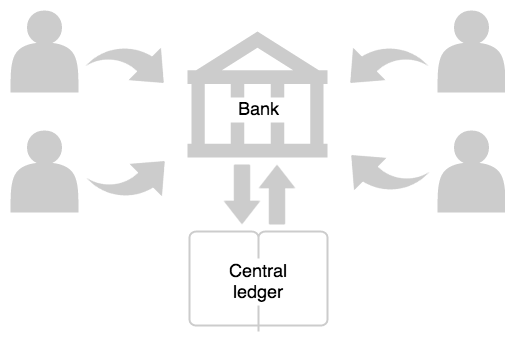

Now, the principle of exchanging cash for goods is solid, but humans are humans and sometimes we do horrible things like try to defraud or steal from one another. That’s where banks step in, to keep your money safe and maintain a record of transactions so that Dave can’t take Bob’s money and then lie about it. These transactions are run through a central ledger that the bank keeps, with the idea of being trustworthy enough to not tamper with and remain entirely neutral on.

But banks are also run by humans and therefore can’t be fully trusted either, which is why most advanced economies have sophisticated regulatory frameworks and institutions like the Financial Services Authority to monitor the banks and keep them in check.

All of this exists because of one thing: trust. We don’t trust other humans, so we invented banks. But we don’t trust banks so we invented systems and institutions to monitor the banks, and have our governments monitor those institutions in turn. And it’s still not enough, as the fallout of the 2008 financial crisis has shown.

Blockchain solves this trust issue by removing the need for it altogether. I’ll explain, but first let me show you what exactly blockchains look like.

Blocks

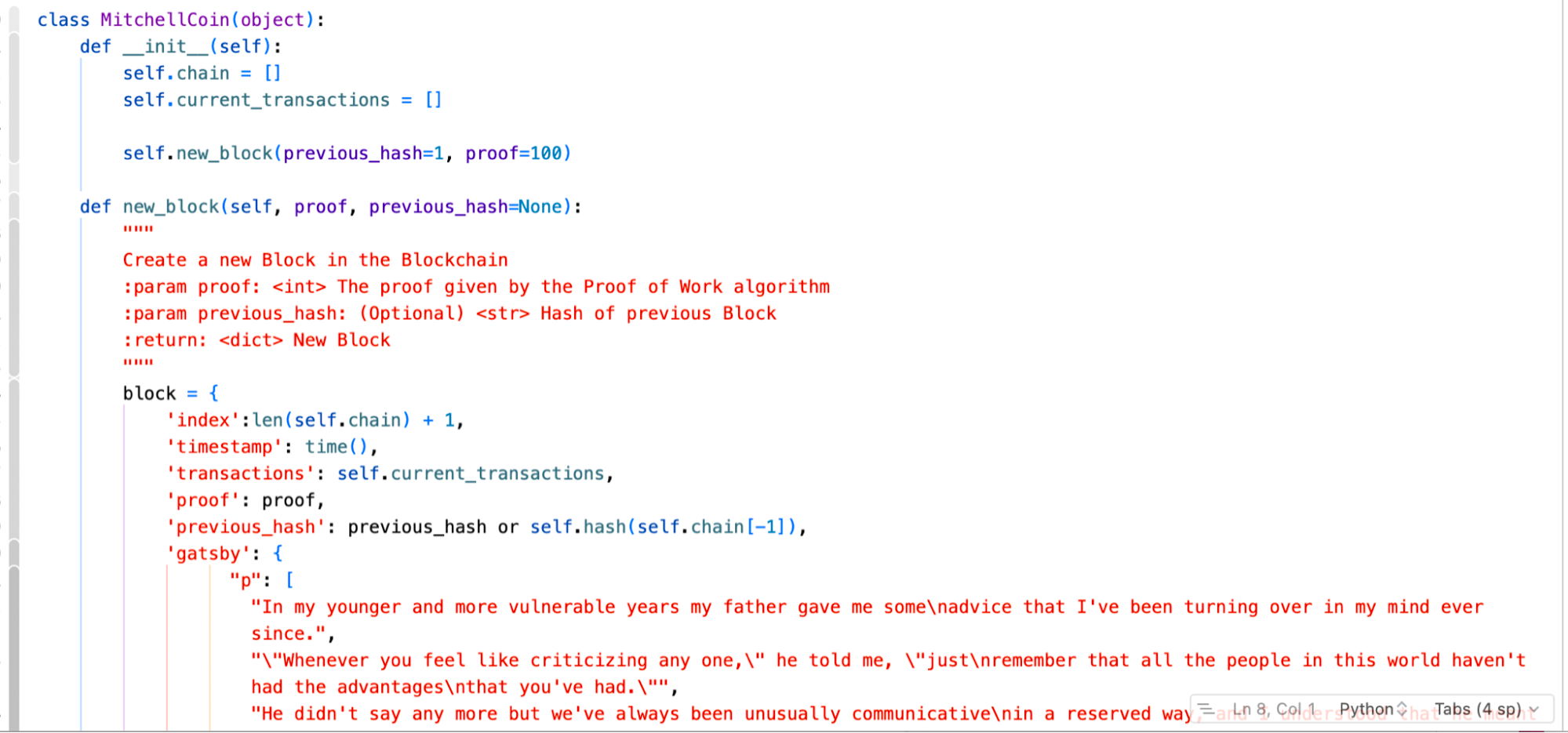

It’s helpful, in understanding blockchain, to actually understand what a “block” is and what it looks like, because frankly there is a lot of talk on the blogosphere about the concept of a blockchain transaction but not much by way of what it actually looks like. So here you go:

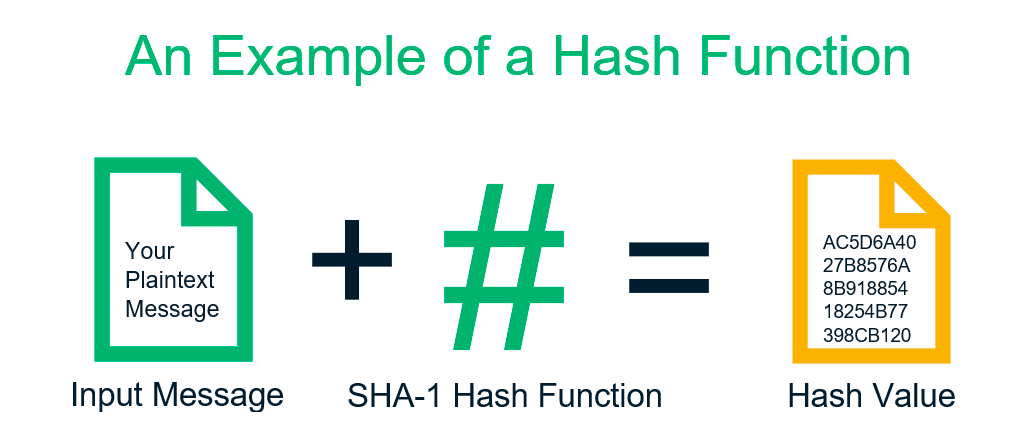

If you understand all that then congratulations, you’re a blockchain developer (call me, I have work for you!). If you don’t, fear not as the point is not to understand what this code does but merely to understand that it is code. That’s it. A blockchain transaction is merely a piece of code that records some kind of transaction, recording everything into things called hashes. You can think of a hash as an encoded (or encrypted, hence crypto) version of any piece of data, made up of a single string of unique letters, numbers and symbols. You create hashes by running data through a hashing algorithm (a common one is the SHA-1 Hash function, which is just a boring name for a specific algorithm that’s widely used) which then spits out the encrypted string, called the hash.

For example, if you run the word hello through an SHA-1 hashing algorithm, it will be converted to D364965C90C53DBF14064B9AF4BAABCA72196E2E. That’s a very simple example of a very small hash. In the world of computers, pretty much everything is data, which means pretty anything can be converted into a hash.

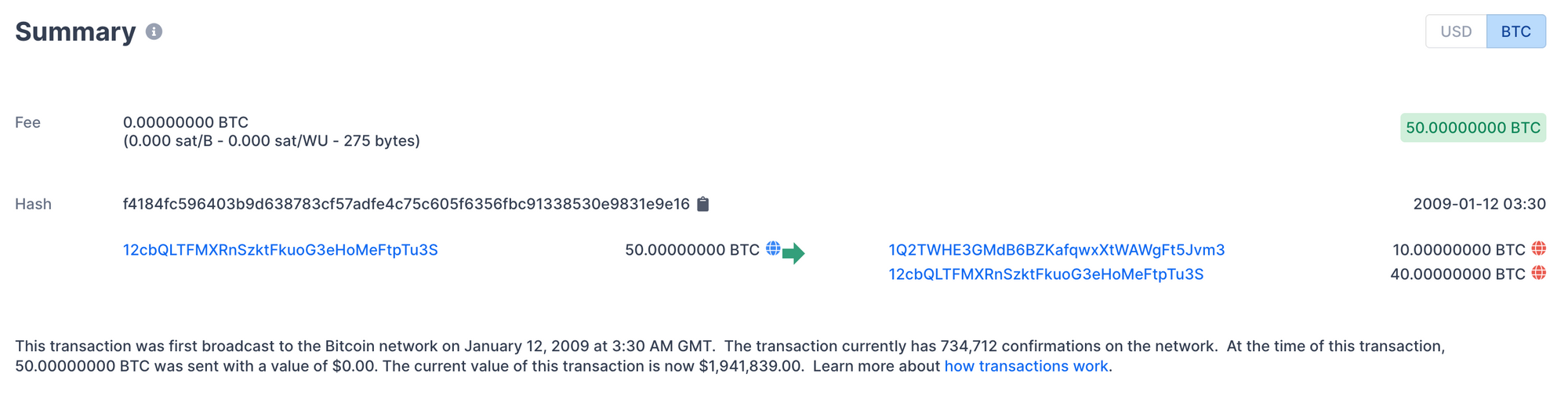

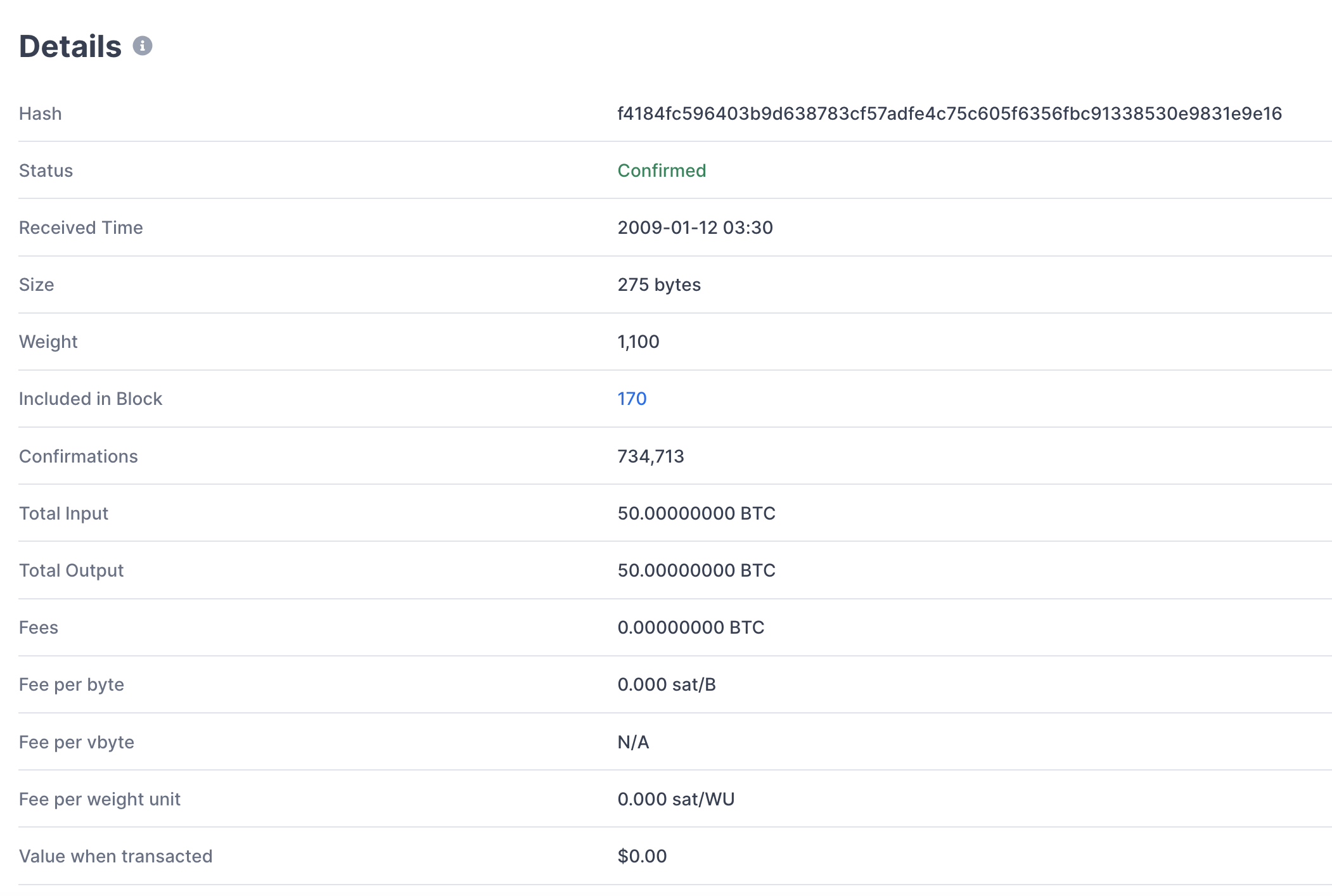

To demystify this even further, you can explore transactions on any given blockchain with the right tool. Here, for example, is the very first transaction ever made on the Bitcoin blockchain: https://www.blockchain.com/btc/tx/f4184fc596403b9d638783cf57adfe4c75c605f6356fbc91338530e9831e9e16

As you will see, everything in this transaction is a hash, including the transaction itself, which you can see as the movement of 50 BTC (the currency symbol for Bitcoin, as GBP is to British Pounds) from one hashed location to two others on the right hand side. Very much like a ledger, I’m sure you will agree, only that the details are encrypted.

Every transaction like this is collected into a block, which is basically a group of transactions bundled up ready to be verified. Further down you can see that this transaction was part of Block 170, which itself contained two transactions total:

A blockchain is simply the full long tail of blocks that have been verified, somewhat like a digital version of a load of receipts tied together on a long piece of a string. As each new block is verified, it is added on top of the last block and so on in an infinitely growing chain of record, hence the term “blockchain”. Blocks, once verified, cannot be altered, which makes blockchains totally immutable. This is an extremely significant aspect of their potential.

Mining

So how do blocks get verified exactly? Surely, without a central institution scrutinising every transaction, fraud is rampant? Well no, and in fact this is where the real genius of blockchain lies, as well as its most criticised feature. In a nutshell, blockchain transactions are verified via a process called Proof of Work (PoW, not to be confused with POW as in prisoners of war), which is a bit of a strange concept to understand at first, so bear with me.

A PoW is, in simple terms, a way of proving that a certain amount of effort has taken place. In blockchain terms, this is achieved by requiring computers to solve deliberately complex problems that need considerable time and computational power to complete. Without getting too technical about it, one way to think of this is that each transaction block on a blockchain generates a unique password hash that other computers on the blockchain network must try to crack by throwing guesses at it repeatedly and randomly until the password is guessed correctly. The first computer to crack the password is rewarded with a newly generated token, which normally represents some quantity of cryptocurrency. This is why the process is called mining: you expend computing energy (and electricity costs) in the hopes of reaping a bounty that has some value.

Any given blockchain network will have multiple - often thousands of - computers connected to it, each computer referred to as a node in that network. Each node carries a complete copy of the entire blockchain that is updated every time a new block is verified and added. Whenever a new block is created, it is broadcast to the entire network and the process of verification begins, with the first node to complete the Proof of Work receiving a bounty of cryptocurrency coins.

You may wonder what the point of this is, as none of this appears to have anything to do with verification. To quote Wikipedia, “the purpose of proof-of-work algorithms is not proving that certain work was carried out or that a computational puzzle was "solved", but deterring manipulation of data by establishing large energy and hardware-control requirements to be able to do so”. In other words, the point of mining is to make it really, really hard and expensive for people to manipulate the ledger as it would require an almost impossible amount of computing power to do so. That’s really it.

For this reason, blockchain technology is often criticised for the heavy fuel consumption that it generates. In fact, recent estimates concluded that it would take the planting of 300 million new trees to offset the carbon footprint of Bitcoin. This is improving in some of the newer blockchains though.

Trust

And so, back to trust. In a banking system without regulations or security, a bad actor could theoretically hack into the central ledger and change it to show lots of money flowing into their accounts, which would obviously be fraud. In the world of blockchain however, there is no central ledger to hack because it is distributed across thousands of nodes around the network, and altering a transaction block would require so much computing power that it simply wouldn’t be worth it to even try. As such, there is no need for any central regulator or other oversight mechanism to prevent fraud; it simply isn’t worth trying.

This very feature of blockchain is what makes its potential so huge, and so frightening for those in power. Without the need for central regulation the balance of power dissipates away from small groups of people and promises to create an almost utopian system where human flaws are circumvented by the purity of computational processes. We don’t need to trust anybody because nobody controls any of it. That’s the stated promise of blockchain.

Part 2: cryptocurrency

Cryptocurrency - often abbreviated to just crypto - and blockchain are often used interchangeably but, as you have hopefully grasped from the previous section, they are not the same thing exactly. Rather, crypto is a product of blockchain technology. A digital asset, basically. To explain further, let’s talk about the most famous cryptocurrency of all, Bitcoin.

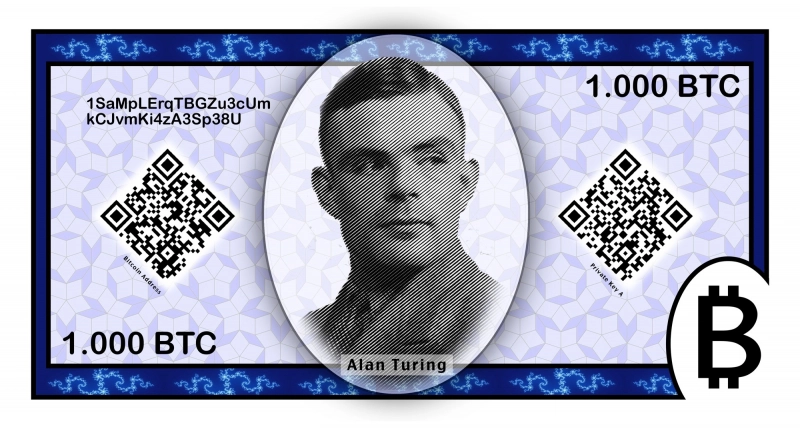

As I have already covered in part 1, Bitcoin was invented as an alternative to cash (or stable assets like gold, depending on which faction you listen to… but that’s a rabbit hole for you to explore in your own time). Bitcoin itself is in fact a blockchain, and the currency that people trade is actually a token - or digital asset - generated on that blockchain. The fundamental feature of blockchain tokens is that they can be stored in things called digital wallets, which you can think of as something like an encrypted computer storage folder that holds digital blockchain tokens. Like a Dropbox folder for your crypto, essentially. The term “wallet”, of course, refers back to the etymology of cryptocurrency as a digital version of money.

When you think about it, cash itself isn’t that much different to crypto. When you hand over a £10 bank note, what you are actually handing over is a certificate that confirms you have £10. You can see this on the note itself via the printed phrase “I promise to pay the bearer on demand the ultimate price” (which, I assume, does not mean death... you never know though with the British hierarchy).

In order to have acquired that £10 note you probably had to get it from an ATM machine and if you’ve ever tried to withdraw cash when broke (ah, student days…), you know that the actual money isn’t really in the cash, it’s at the bank, sitting on a ledger somewhere. No money in your bank account, no crisp paper tenner for you. At a stretch you could argue that withdrawing money is a bit like minting a token (a banknote) from a cash machine, although minting itself is actually the process of creating those banknotes in the first place. In the UK, like most countries, that minting takes place at a central minting institution - the Royal Mint, in our case - at the behest of the country’s Central Bank - the Bank of England, for example. Bitcoin, however, is a blockchain, which means it is decentralised and no single agency controls or regulates it. The minting (i.e. the generation of new coin tokens) happens as a result of mining as explained in the previous section.

Since Bitcoin, many other public blockchains have been developed including well-known ones like Ethereum (more on that in the next section) and Tezos. All of these blockchains have their own native coins that are minted in much the same way as Bitcoin. With some of the more recent blockchains - Ethereum included - the underlying blockchain is more evolved than Bitcoin and allows for non-native tokens to be built on top of the blockchain. This has led to some additional coins being developed as tokens on top of blockchains like Ethereum, which has resulted in a recent explosion in different crypto coins available. At time of writing, there are an estimated 1,000 public blockchains in the wild and more than 12,000 different crypto currencies, all with their own varyingly weird names and currency symbols. This partly explains why there has been so much hype and volatility around crypto.

How crypto gains value

One interesting feature of Bitcoin’s coin is that it has been programmed to have a limit of 21 million coins total, with the bounty (aka number of coins) for successful mining halving every four years. It is expected that the last Bitcoin will be mined around 2040, after which there will be no more new minting. This gives it a natural scarceness that makes it desirable as an asset.

A few years ago crypto exchanges started to appear that allowed people to exchange real money - fiat currency - for crypto tokens. As these exchanges gained in popularity, simple supply and demand economics pushed the price of crypto up and down based on the whims of the market. Basically, cryptocurrencies like Bitcoin acquire value in the same way stocks do, and are prone to the same spikes and crashes as a result. The difference between more established assets like stocks and fiat currency is that these traditional assets tend to have more solid underpinnings to keep them stable (although events like the Dotcom bubble of 2000 show how that doesn’t always pan out). Crypto, meanwhile, is just code with no physical underlying asset or mechanism to control it, leading to occasionally wild fluctuations in price as day traders, speculators and whales like Elon Musk pile in and contribute to fragile market sentiment.

Its lack of regulation also makes it attractive to people who, for either nefarious or legitimate reasons, can’t rely on fiat currency. This includes criminals of course, a much-publicised contingent of the crypto industry, but increasingly has also included certain developing countries whose own currencies have become untenable for various reasons. Governments including the Venezuelan one have started to diversify into crypto themselves in order to try and counter the weaknesses of their own currencies.

All of this activity, coupled with resistance from established institutions who want to keep currency centrally regulated, means that crypto is likely to remain volatile for quite some time. But its underlying architecture and concept is extremely sound and my personal view is that all of this volatility is just part of the normal early tremors of major socioeconomic change.

Investment or cash alternative?

As an investment, crypto has a very different profile to most other investment vehicles (bar Forex trading, perhaps). Its long-term outlook is so hard to determine because there is nothing tangible underpinning it, and while the prospect of making huge amounts of money on nascent crypto coins is appealing, it is generally considered unwise to invest money into crypto that you are unwilling to lose. On the other hand, its decentralised nature makes it an intriguing alternative to other tangible asset classes like gold, which is exposed to the same issues as other centralised asset classes in that, put simply, it can be stolen or controlled in such a way as to manipulate. Such things are theoretically impossible with crypto, meaning its long-term value as an asset class is potentially more robust than the more traditional tangible assets most developed economies have relied upon for centuries.

Bitcoin was initially invented as an alternative to cash, although this itself has become a controversial sentiment. In that sense, its competition is not gold or government bonds but credit and debit cards like Visa and Mastercard. Here it has so far been slow to gain traction, partly because the whole process of setting up a crypto wallet and trading has, until recently, been extremely technical and opaque, but also because technologies like Bitcoin are simply too slow for practical everyday use. Would you be willing to wait ten minutes for a Bitcoin transaction to go through while you’re paying for your coffee at Starbucks? Would the people in the queue behind you?

Although newer blockchains and other developments have improved the transaction speeds for blockchain currencies, they still lag far behind the speed and ubiquity of the major credit cards. But the general belief is that they will catch up eventually.

Like money, but with ones and zeroes

In conclusion, cryptocurrencies are, at the ground level, nothing more than bits of computer code encrypted into hashed tokens, generated through a process of heavy computational problem-solving whose purpose is to verify blocks of transactions on a blockchain. Coin tokens are fungible, meaning they can be exchanged for other tokens, which has led to crypto exchanges where crypto is traded, driving up its value.

That’s it, in a nutshell. But coin tokens are only part of the blockchain featureset. There are more advanced types of token that make things even more interesting.

Part 3: NFTs and smart contracts

Which brings us, finally, to NFTs, the newest kids on the block… chain. Until the next big new thing, that is. In fact this article is probably already out of date by the time you read it; the world of blockchain moves fast. But until I’m categorically proven to be behind the times, let me get into what an NFT is.

The easy part is the definition. NFT stands for Non Fungible Token, meaning a token that cannot be directly replaced with something else that’s identical, because there is no identical substitute. In the real world, examples of fungible items include coins, where if you swapped a £1 coin with another £1 coin, you still have a £1 coin - something that’s identical in a practical sense to the original thing you exchanged. Diamonds, meanwhile, are non-fungible because every diamond is unique and cannot be replaced like-for-like. NFTs are the crypto token equivalent of diamonds: whereas crypto coins can be exchanged like physical coins of equal value (making them fungible, as Bitcoin is), NFTs are entirely unique tokens.

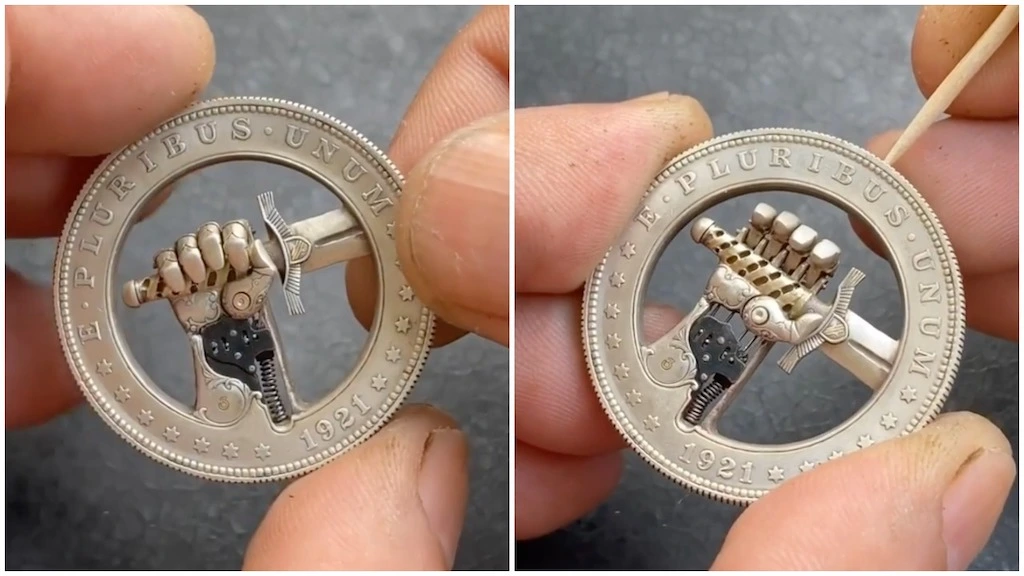

This concept might seem pretty pointless when applied to crypto coins. After all, what’s the use of a totally unique coin? Well actually, the answer to that gives us a clue as to the value of NFTs. Because totally unique coins do exist in the real world, in the form of limited edition commemorative coins issued for special events or even as intricate pieces of art like this beautiful coin created by Russian artist Roman Boteen:

The difference between this coin and a normal coin is that Roman’s coin is a non-fungible asset whose value is based on its unique properties and rarity rather than its overall trading volume on an exchange. It is a piece of art, an entirely different asset class. Now, let’s assume you buy one of these coins (or any work of art): how would you prove that you own it, and that it is authentic? Normally you would have some sort of certificate accompanying it which supplies recorded evidence of your ownership and the authenticity of the item you have purchased. Without this certificate it is much harder for you to prove your ownership and the authenticity of the item becomes a matter for experts to ascertain through forensic means. The fine art world is all too familiar with this paradigm.

NFTs are basically digital versions of these certificates. In a literal sense they are tokens which, if you recall from part 1, are just hashed versions of some kind of data. The difference between NFTs and standard coin tokens is that the hashed data in an NFT also contains additional code in the form of a small program that can execute as part of a transaction. This is referred to as a smart contract, an extremely important innovation in the world of blockchain. So let’s get into those a little.

Smart contracts

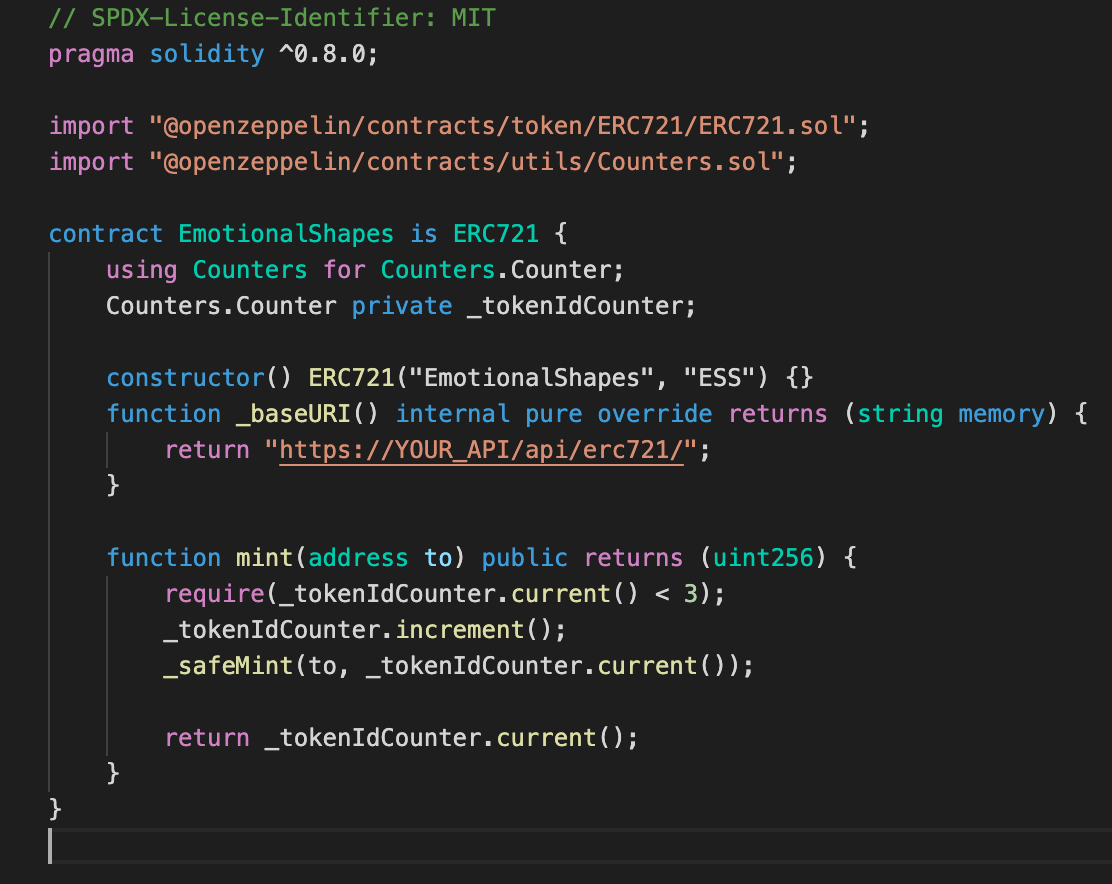

Bitcoin, despite being the first major blockchain to gain mainstream adoption, is actually quite basic in its functionality. It can mint coins and record transactions of coins, but that’s all. A few years after its launch, Bitcoin’s limitations led to the birth of a new blockchain that allowed for not only coins, but executable code, to be minted. This blockchain was called Ethereum, and it introduced the concept of smart contracts to blockchain. A smart contract is basically a small computer program - code, written in Ethereum’s bespoke programming language called Solidity - that executes automatically based on defined conditions. Here’s an example of a smart contract:

Don’t worry, you’re not meant to understand all this but hopefully you can recognise that this is just code, like any other software. And it’s also quite a small program as most software applications contain thousands upon thousands of lines of code. A smart contract is basically a small app that does something automatically when certain conditions are met, much like a real world contract. Let me elucidate with an example.

Let’s say I want to hire a designer to create a new logo for me. I find a designer and we negotiate a fee, only the fee will be paid in ETH, Ethereum’s native coin (and the second largest crypto currency by market cap after Bitcoin, incidentally). I design a smart contract which contains a function called Accept that, when executed, will release the agreed amount of ETH to the designer. To create this smart contract I have to mint it on the Ethereum blockchain just like any other blockchain token, and it is recorded as a transaction on the blockchain, immutably, along with every other transaction. While the designer is working, the smart contract effectively acts as a digital escrow. When the designer has successfully delivered my logo, I execute the Accept function and the ETH is automatically transferred to his wallet.

In a simplified way, my smart contract would look something like this:

function Accept = {

transfer 100 ETH from "Marc's wallet" to "Designer's wallet"

}

In other scenarios you can create contracts whose functions are executed automatically once certain conditions arise. For example, let’s say you make a bet with your friend that it will rain tomorrow: you could write a smart contract that automatically checks weather.com every 15 minutes the following day and, if it finds that it is or has been raining, will automatically transfer the funds to you. That contract could look, again simplistically, like this:

function CheckForRain = {

get "forecast" from "weather.com"

if ("forecast" contains "rain") then

transfer 100 ETH from "Dave's wallet" to "Marc's wallet"

}

The potential applications for smart contracts are incredibly wide-ranging which is what makes this technology so exciting. The official Ethereum website is as good a place as any to start exploring that topic when you’re ready, but for now let’s get back to NFTs.

Now you understand what a smart contract is, and what a blockchain token is, we can put these two pieces together and explain what an NFT is: a unique, non-fungible token, created by a smart contract, that proves ownership of an asset. How? Read on.

Beyond coins

If you recall part 1, I explained how a token is essentially an encrypted version of some data, called a hash. Now, since everything digital is fundamentally a piece of data, that means almost anything can be theoretically converted into a token. Images, documents, music files, videos, even apps could technically be hashed into a blockchain token. Of course this is incredibly impractical due to the file sizes involved in encrypting such things, but what if you could create a token that describes an asset like this, and also records your ownership of it? Much like the certificate of ownership and authenticity I mentioned in relation to physical artworks?

Bingo: that’s basically what an NFT is. It is a token that contains metadata (which is a fancy computer term for “data that describes other data”) about some other asset, such as - you guessed it - an image, document, music file, video or pretty much anything you can think of. Here’s an example of what one of these NFT metadata files looks like, taken from this article:

{

"attributes": [

{

"trait_type": "Shape",

"value": "Circle"

},

{

"trait_type": "Mood",

"value": "Sad"

}

],

"description": "A sad circle.",

"image": "https://i.imgur.com/Qkw9N0A.jpeg",

"name": "Sad Circle"

}

An NFT can only have one owner (this is enforced by the Ethereum blockchain network), and ownership of any given NFT token is recorded on the blockchain each time it changes hands, like a permanent record.

Minting an NFT

So an NFT is just a description of some other asset, and is also unique. Where does the smart contract come into it? The answer is minting. You need to create a smart contract with a function that will mint an instance of your NFT based on whatever conditions you set. The simplest example of such a contract would be one that enforces a maximum number of instances of an NFT to create a limited edition collection. The smart contract code for that might look something like this (as always, this is simplified code):

function MintNFT = {

if ("totalNFTs" is less than 10) then proceed

}

This would only allow minting of new NFTs if the total number of minted NFTs is less than 10. Once minted, the NFT transfers to the wallet of the person who minted it and this transaction is recorded on the blockchain like any other transaction, preserved for all time.

The hype and the obvious use cases

Understanding how an NFT works it should now make sense why the most popular use case for it is to sell digital art online. Previously, selling pictures via the web was a losing game because it’s far too easy to simply save a digital image as a perfect copy, thereby making it very difficult to prove who the original creator of an image was or track copies of it. With NFTs, this is now done via the smart contract mechanism I have just described.

The other cool feature of smart contracts is that, because they are just computer code, artworks can be created algorithmically. The most famous example of this is the Bored Ape Yacht Club, a collection of drawings of cartoon apes. The creators designed multiple variants of each part of the ape’s face - different mouths, eyes, hats, clothes and so on, 172 features in total - and an algorithm would combine these features randomly to create unique ape faces each time one of the NFTs was minted. The collection was capped at 10,000 NFTs which rapidly became collectors’ items.

Music is another obvious use case for NFTs, where smart contracts can automatically track plays of a song and pay royalties back to the artist without needing a middleman. Items in video games are another area being explored as a candidate for NFTs, the idea being that gamers could acquire items in games such as special weapons and then retain those as NFTs. This has significant implications for other types of digital possession in the forthcoming Metaverse, but that’s a whole other topic.

There are many other potential applications for NFTs being explored, which is understandable once you know how they work. A full discussion of the potential is beyond the scope of this article but hopefully your imagination has been sparked already.

Next steps

Hopefully by this point you understand blockchain technology, crypto and NFTs enough that you can navigate the hype and start to germinate ideas of how this technology could be of value to you or your business. From here there is plenty of additional learning you can undertake to explore the subjects further, depending on which aspect piqued your interest most. For example:

- A quick guide to getting started with buying and selling crypto

- A short documentary on the history of Bitcoin

- A list of online courses for learning blockchain in more depth

- Create and sell your own NFTs

If this has got you all a-tizzy about the possibilities presented by NFTs and blockchain and you want to talk about it, you can also drop me a line and I’ll be happy to discuss it with you. Until then, happy minting!